What does this mean for local governments and council revenue?

The COVID-19 is a global health crisis, however we are now more aware of the real and significant economic impacts for Australia, potentially greater than the global financial crisis. All levels of government are responding to the economic crisis – local governments included.

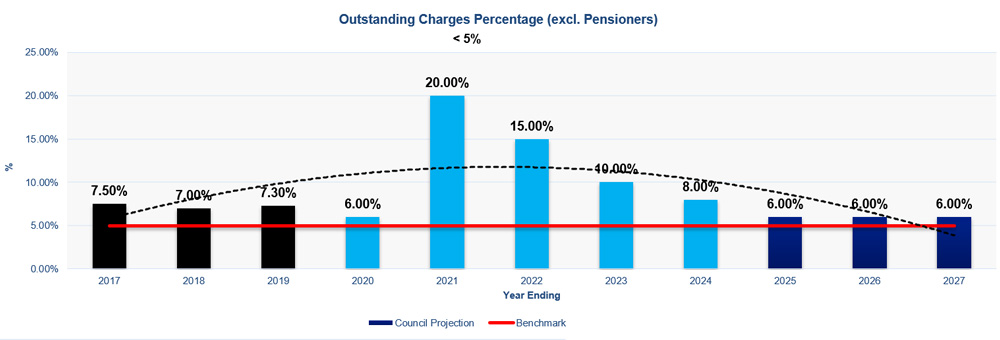

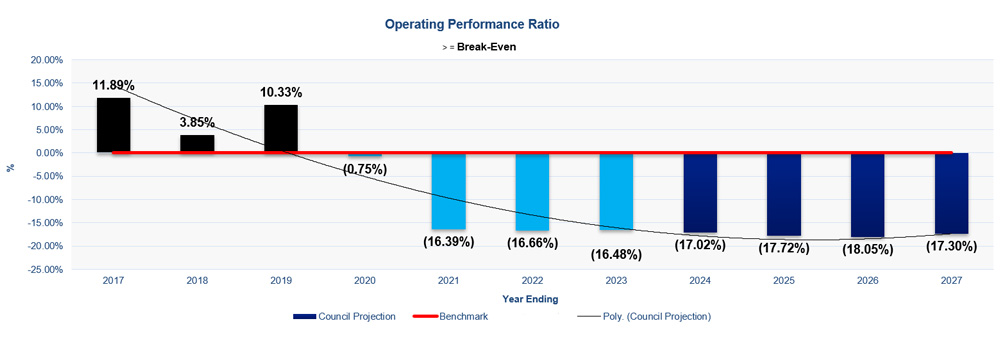

Most certainly it means a significant impact to the rate revenue, both in terms of the rate arrears, but most definitely bad debt with the closure of small and medium businesses. Any previous long-term financial planning will need to be reviewed.

Council will most certainly need a basis (a policy) for making decisions on hardship, one that is fair and equitable but also practical and timely as every council will need to consider a large number of applications.

Will council consider each application or will the policy establish administrative delegations-based criteria established by the council?

What will be the likely financial implications of the policy and have they been included in a revised long term financial plan?

Councillors and the administration will be under pressure to implement discounts and rating relief, creating further challenges to the revenue projections for council. CT Management Group has assisted in developing rating policies for over 20 years. We have rating experts experienced in debt recovery from disasters that can assist councils with developing policy positions, including the likely risk and benefits of revenue discounts and rating relief as well as modelling the financial impacts of the policy.

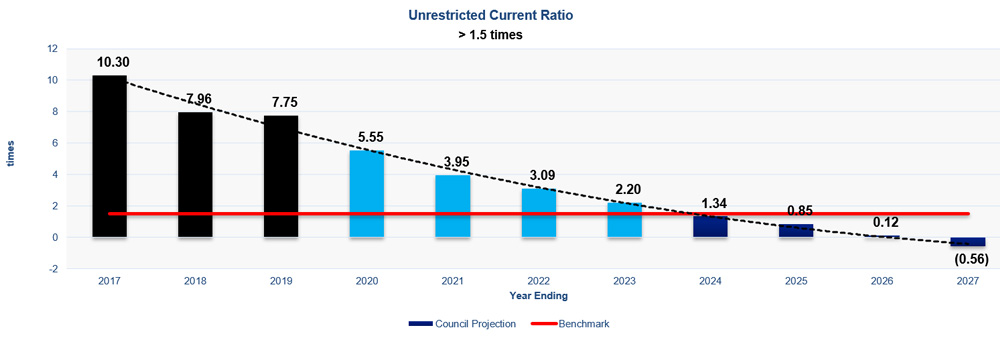

The economic impact of COVID-19 will most definitely challenge the underlying cash position of many councils – particularly regional and rural councils.

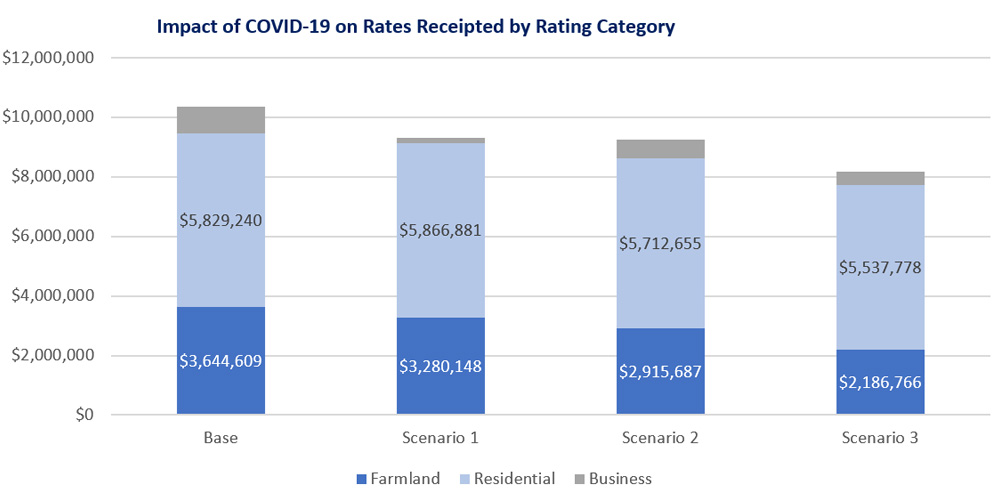

Councils need to be able to predict what the impact to council revenue and cash base is likely to be on a range of scenarios and begin to mitigate the impact now. CT Management Group has a rate modelling tool with the expertise in rating to be able to forecast the impact on different rating categories. Each rating category presents a different risk to the council, whereas residential rate debt may be recoverable over the long term, for companies that are forced to close, that revenue is unlikely to be recoverable – in full at least.

CT Management Group can model the impact at an assessment level, enabling different scenarios to be applied based on rating category, suburb, valuations, pension status etc.

Given the reduced likely cash position for the next 12-24 months, councils will need a basis upon which to consider reducing expenditure, reducing the planned capital works, use an overdraft or borrowings or deplete the cash holdings. In the medium term (3-6 moths), the cost of services (and planned capital) will need to be considered through sustainable service planning.

If you would like to discuss this further and find out how CT Management Group can assist your council in modelling the rate revenue and the potential impact on the long-term financial plan, please contact us on 1300 500 932 or via the form below.