April 2023

Michael Courtney

Managing Director

Sector wide program required to meet financial sustainability challenges

CT Management Group continues to receive the support of the Local Government sector on the east coast of Australia.

We are grateful for our clients ongoing support and continue to learn from our clients and adapt to their needs.

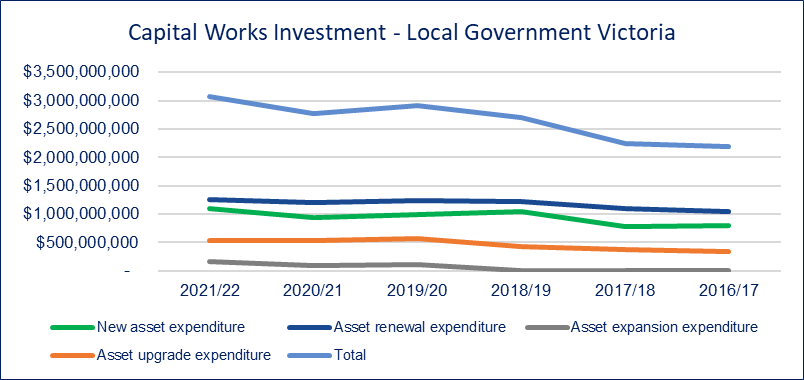

We have recently reviewed capital investment in Victoria post rate capping and are pleased to report that the sector in Victoria has continued to invest in its communities.

In 2016 the Victorian Government introduced rate capping with the aim to reduce the financial burden on households and businesses and to make Councils more accountable for their spending.

Critics argue rate capping has restricted the ability of Councils to invest in important infrastructure or reduce expenditure on important services.

Prior to rate capping in Victoria the average annual rate increase of the sector was 6% p.a over the preceding five years (2010 – 2015).

Prior to rate capping the Victorian local government sector rated 3.8% above the average CPI of the preceding 5 years (2010 -2015).

The average rate cap between 2016 and 2022 was 2.2%.

Victorian Councils investment in infrastructure since the introduction of rate capping (2016 – 2022) has in fact been on the rise. Also, investment in renewal and upgrade has kept pace with depreciation charges.

Over this 6-year period $9.85bn has been invested in asset renewal and upgrade compared to $9.6bn in depreciation charges. Upgrade investment was $2.8bn.

Interestingly useful lives of infrastructure assets have increased from an average of 42 years in 2016/17 to 62 years in 2021/22 a significant movement. This has lowered the annual depreciation charges over time. Queensland’s infrastructure asset useful lives in 2021/22 were 55 years and in 2018/19 58 years.

Victorian Councils have improved their condition data and accordingly the extension of useful lives may be justified.

As a proxy analysis this means the write off and reinvestment in infrastructure is equivalent.

What we are starting to see in Victoria is the impact of rate capping as the accumulative loss in revenue raising capacity challenging the growing cost structures of many Councils.

This tightening of financial capacity is challenging Councils in the preparation of their 2023/24 Budgets and many are now addressing their service management frameworks to determine if the range of services at their current level aligns with strategic priorities and is sustainable into the future.

The impact of future demand for services and its impact on financial sustainability has been an area of interest for our service planning clients.

In NSW we have assisted Councils with special variations and IPART has been receiving astronomical rate increase requests form Councils throughout the state. The long-term impact of rate pegging has resulted in requests for 100% increases over 3 years in some instances!

Effectively the Councils cannot provide services and restore capital at a level that ensures ongoing basic safety for their communities.

In Queensland, a rate cap free state, the tyranny of distance and remoteness impact the Councils’ capacity to maintain and invest in adequate infrastructure.

We are assisting several Councils with Service Planning and Asset Management requirements in Queensland and NSW with the common theme around levels of service, future demand, and priorities.

We believe in, each jurisdiction, a sector wide Financial Sustainability Assessment Program in each state would assist Councils:

- Understand the true long term financial position of Councils.

- Achieve more informed and uniform approaches to data – Asset Plans, useful lives, unit rates capital evaluation etc.

- build capacity and capability to meet the challenges of sustainable service delivery.

- provide a forum for professional development.

- enable effective benchmarking across key indicators.

- strengthen the advocacy of LGNSW, MAV and LGAQ to support a sustainable local government sector.

Your thoughts would be appreciated!

Michael Courtney

Managing Director

CT Management Group