Many readers of the Queensland Audit Office Report “Local government entities: 2018-19 results of financial audits” may be excused for questioning – have I read this before?

While the Queensland Audit Office (QAO) have highlighted more recent issues (for example, implementation of IT solutions), the key issue of sustainable management of assets and prioritising capital investments remain the same.

QAO concluded (again) that:

- More than half of the councils continue to spend more delivering services to their community than they receive in revenue from rates, fees and charges, and grants. This is particularly the case in rural, remote and Indigenous areas.

- Councils need to know which services their community’s value. This enables them to make informed decisions when deciding which services to provide and when managing costs.

- When councils understand the performance, cost, and age of their assets, they can make informed decisions about their renewal, maintenance, and replacement.

And the recommendations (again) are:

- Councils need to use accurate information about their assets, including asset performance (for example, current performance compared to the future performance required by the community) and cost, to inform their long-term asset management strategies and budget decisions.

- Councils need to strengthen how they control the recording of data on assets. They should regularly match the data in the financial records with the data in their geographic information systems to ensure they are both complete and reliable.

- Councils need to allocate enough time and resources early in the financial year to complete the asset valuation and asset accounting processes well before year end.

The QAO have assessed 21 Councils with a moderate risk of sustainability and 21 at a high risk. Given the lack of confidence in the understanding of assets and the inability to forecast future asset expenses (as highlighted in previous QAO reports), CT Management Group believe that the risk is significantly higher than that assessed by the QAO.

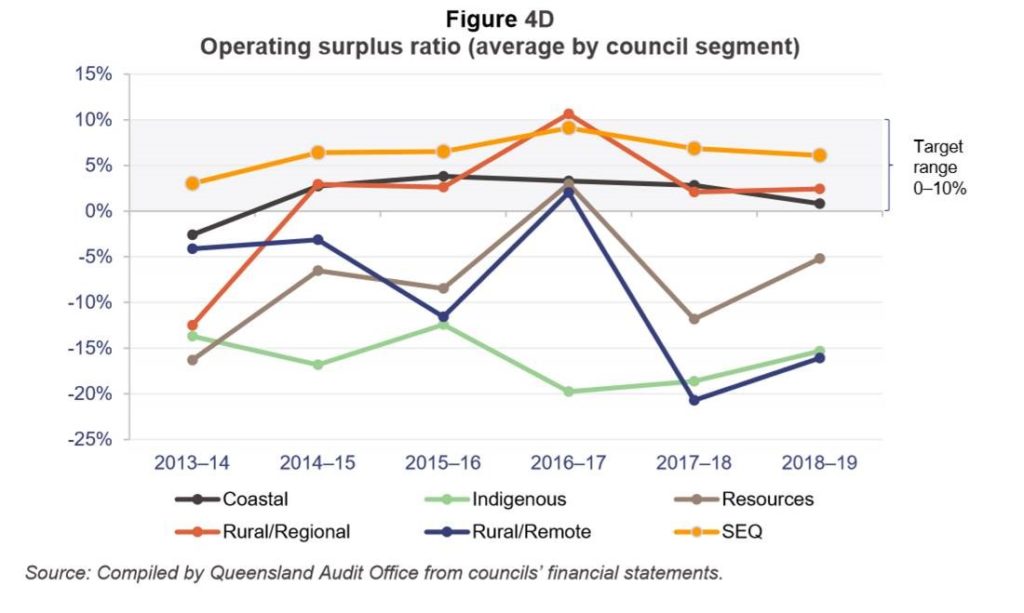

Given that an operating surplus is important for the ability of local governments to fund capital renewals, service debt and upgrade infrastructure for growth; it is concerning that the QAO have reported that more than half of councils are spending more than they earn. Below is an extract of Figure 4D from the QAO report. Making this worse is a growing asset base, placing more stress on the revenue base to operate and maintain the assets, as well as a higher reliance upon grant funding to replace failing assets.

It may also occur that the operating surplus ratio for local government should not change so significantly, especially as Figure 4D is reporting averages by council segment. This highlights the need to report to Councillors the underlying operating position (ie without capital grants and expenses). It is also often more informative to analyse the cash generated from operations rather than the operating surplus, as the cash surplus from operations shows the true capacity of a Council to fund capital expenditure and service loans.

CT Management Group has provided analysis and advice to a large number of Australian local governments on sustainability – from small rural to large city Councils. We assess the maturity of asset management, build asset renewal projections, develop capital works plans, prepare business cases and review utility pricing for water, sewer and waste. Finally, at any point in time our Long Term Financial Planning service and products are being used by over 50 local governments. We are the leading local government advisory in financial sustainability and our experienced Associates are available to undertake new projects for Councils.

If you would like to discuss how CT Management Group can help you understand your sustainability and provide advice on improving your long term sustainability, please contact Graham Jarvis on 1300 500 932 or via the form below.